This past year presented Villanova with the most significant financial and operational uncertainty of its modern history, as the pandemic threatened our ability to provide the campus-based experience that is the foundation of our undergraduate program. While the campus experience of the year ending May 31, 2021, was very different because of the need to protect the community from the virus, I am proud of the fact that Villanova was able to maintain a campus-based experience at a time when many other institutions were unable to do so.

Our success was the direct result of the extraordinary efforts and sacrifice of the entire University community—faculty, staff and students—during a period of time when flexibility, perseverance and acting in the interest of the greater good were demanded more than ever before.

The pandemic significantly affected Villanova’s operations in many ways in the past year—events on campus were cancelled, students were unable to study abroad and significant unbudgeted costs were incurred in order to safeguard the health of our community, to name just a few. As a result of cost containment measures, implemented in June 2020, as well as ongoing efforts throughout the year by the campus community and sustained philanthropy from our loyal benefactors, Villanova was able to maintain its operating margin.

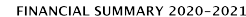

Despite the significant disruption to the global economy that resulted from the pandemic, financial markets performed extraordinarily well. This was evident in the growth of the endowment in the past year, from just under $800 million on May 31, 2020, to more than $1.1 billion as of May 31, 2021, reflecting a rate of return of 38 percent.

Other highlights from Fiscal Year 2021 include the following:

- Endowment support for operations reached an all-time high of more than $35 million, which represented just under 7 percent of total operating revenue.

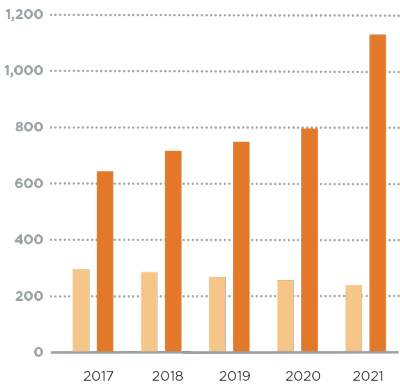

- Primarily as a result of the growth in the endowment, net assets grew from $1.4 billion as of May 31, 2020, to $1.8 billion as of May 31, 2021.

While the pandemic is certainly not behind us, our experience of the past year provides us with the ability to resume investment in the strategic plan, Rooted. Restless., including planning for the renovation and expansion of the Center for Engineering Education and Research, which will be the first major facilities project associated with the plan.

In resuming our investment in the strategic plan during Fiscal Year 2022, we will do so with ongoing prudence. As we monitor the pandemic, we will continue to incorporate the University’s long-standing fiscal discipline and commitment to financial sustainability into all of our planning.

Neil J. Horgan

Vice President for Finance and Chief Financial Officer

Balance Sheets

($ in thousands) as of May 31

Table of Assets and Liabilities from 2019-2021

| 2021 | 2020 | 2019 | |

|---|---|---|---|

| ASSETS | |||

| Cash and Short-Term Investments | $ 126,321 | $ 175,244 | $ 121,275 |

| Long-Term Investments at Market | 1,234,909 | 867,732 | 821,226 |

| Accounts Receivable, net | 67,661 | 80,317 | 103,796 |

| Other Assets | 6,396 | 6,210 | 6,736 |

| Assets Whose Use Is Limited | 2,067 | 2,111 | 2,085 |

| Prepaid Pension Asset |

1,189 | — | — |

| Student Loans Receivable, net | 6,154 | 7,262 | 9,101 |

| Right-of-Use Assets, Operating Leases, net |

15,973 | — | — |

| Land, Buildings and Equipment, net | 717,114 | 741,930 | 711,241 |

| TOTAL ASSETS | $2,177,784 | $1,880,806 | $1,775,460 |

| LIABILITIES | |||

| Accounts Payable and Accrued Expenses | $ 69,654 | $ 53,531 | $ 81,664 |

| Deposits and Deferred Revenue | 34,706 | 40,695 | 31,116 |

| Short-Term Lines of Credit | — | 60,000 | — |

| Long-Term Obligations | 236,822 | 254,044 | 268,124 |

| Operating Leases | 16,076 | — | — |

| Other Liabilities | 16,635 | 23,834 | 24,794 |

| TOTAL LIABILITIES | 373,893 | 432,104 | 405,698 |

| NET ASSETS | 1,803891 |

1,448,702 | 1,369,762 |

| TOTAL LIABILITIES AND NET ASSETS | $2,177,784 | $1,880,806 | $1,775,460 |

Endowment vs. Long-Term Debt

($ in millions)

Table of Endowment vs. Long-Term Debt

| 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|

| Endowment ($) - orange | 641 | 711 | 743 | 797 | 1,123 |

| Long-Term Debt ($) - peach | 295 | 282 | 268 | 254 | 237 |

Net Assets

($ in millions)

Table of Net Assets

| 2019 | 2020 | 2021 | |

|---|---|---|---|

| Total Assets ($) - dark blue | 1,775 | 1,881 | 2,178 |

| Total Net Assets ($) - gray | 1,370 | 1,449 | 1,804 |

Unrestricted Revenues

($ in thousands) as of May 31

Table of Operating Revenues

| 2021 | 2020 | 2019 | |

|---|---|---|---|

| OPERATING REVENUES | |||

| Student-Related Revenue: | |||

| Student Tuition and Fees | $ 480,736 | $ 461,867 | $ 452,154 |

| Sales and Services of Auxiliary Enterprises | 75,392 | 71,079 | 77,551 |

| $556,128 | $532,946 | $529,705 |

|

| Gifts | 15,694 | 14,371 | 14,641 |

| Private Grants | 2,076 | 2,032 | 1,961 |

| Government Grants | 9,826 | 8,827 | 7,303 |

| Endowment Resources | 17,011 | 14,733 | 12,829 |

| Investment Income | 2,234 | 4,004 | 5,026 |

| Other Sources | 19,455 | 28,727 | 31,113 |

| Net Assets Released from Restrictions | 22,773 | 24,023 | 21,765 |

| TOTAL OPERATING REVENUES | $645,197 | $629,663 | $624,343 |

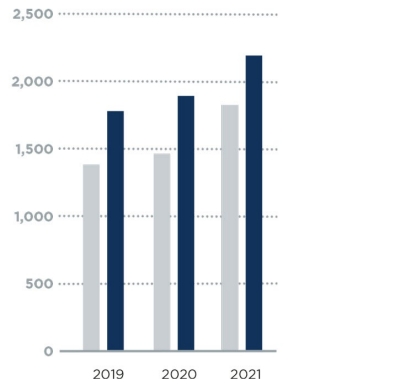

Sources of Operating Revenue 2021

Table of Operating Revenue Sources for 2021

| Tuition and Fees (dark blue) | 74.5% | $ 480,736 |

| Auxiliary Services (orange) | 11.7% | 75,392 |

| Investments (dark grey) | 5.9% | 37,761 |

| Gifts and Grants (medium blue) | 4.3% | 27,596 |

| Other (peach) | 3.7% | 23,712 |

| $645,197 |

Unrestricted Expenses

($ in thousands) as of May 31

Table of Operating Expenses

| 2021 | 2020 | 2019 | |

|---|---|---|---|

| OPERATING EXPENSES | |||

| Salaries and Employee Benefits | $ 307,660 | $ 297,543 | $285,608 |

| Financial Aid | 153,961 | 142,523 | 139,708 |

| Supplies, Services and Other | 101,911 | 112,058 | 117,525 |

| Depreciation | 37,631 | 33,070 | 26,847 |

| Interest on Indebtedness | 8,319 | 8,849 | 4,221 |

| Utilities | 6,300 | 6,659 | 8,265 |

| TOTAL OPERATING EXPENSES | $615,512 | $600,702 | $ 582,174 |

| AMOUNTS RESERVED FOR CAPITAL EXPENDITURES, DEBT PRINCIPAL PAYMENTS AND STRATEGIC INITIATIVES |

$29,685 | $28,961 | $42,169 |

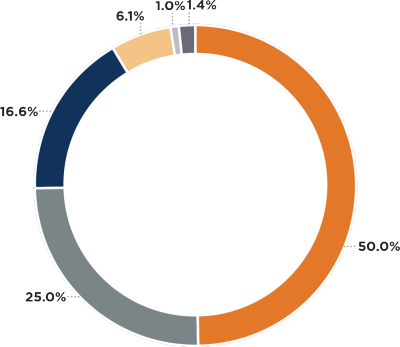

Distribution of Expenses 2021

Table of Expense Distribution in 2021

| Salaries and Employee Benefits (orange) | 50.0% | $ 307,660 |

| Financial Aid (dark grey) | 25.0% | 153,961 |

| Supplies, Services and Other (dark blue) | 16.6% | 101,911 |

| Depreciation (peach) | 6.1% | 37,361 |

| Utilities (light grey) | 1.0% | 6,300 |

| Interest on Indebtedness (medium blue) | 1.4% | 8,319 |

| $615,512 |