Throwing in the Towel: Federal Consequences for Retiring Professional Athletes in 2023

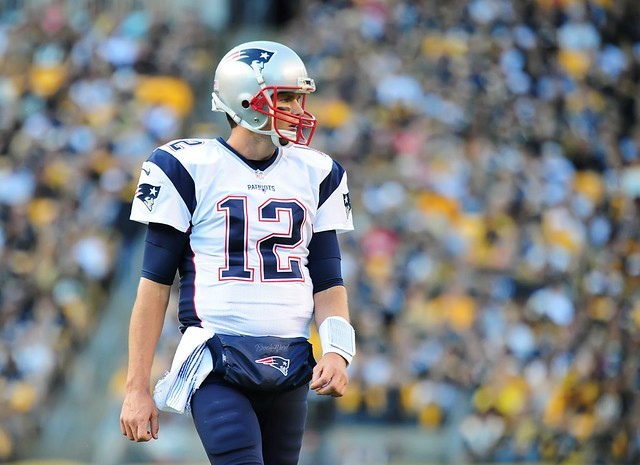

Photo Source: Brook Ward, Tom Brady, Flickr (Feb. 7, 2021) (CCBY-SA 2.0)

By: Nicole Antolino* Posted: 03/21/2023

After twenty-three seasons, seven Super Bowl rings, and a post-retirement-comeback season, legendary football quarterback Tom Brady announced he is finally throwing in the towel and retiring for good.[1] As one of the world’s most decorated professional athletes in National Football League (“NFL”) history, Brady’s career is nothing short of unprecedented in sports.[2] Beyond his accolades, Brady’s departure from the NFL at age 45 draws an interesting juxtaposition between an objectively late retirement for professional athletes and premature retirement in most other contexts, including United States federal programs and benefits.[3]

The average professional athlete completes his or her career in three to five years, most of whom leave their respective leagues before they turn 30.[4] In sports, aging athletes often choose to retire because the scale moves away from the fun and towards pain on the body, or more commonly, they are forced out of the game by newer, younger blood.[5] However, these “retiring” athletes are not filing Social Security Administration forms or receiving tax breaks like other retirees.[6] The legal distinction is the age requirement necessary to qualify for United States federal benefits such as Social Security Benefits, higher tax deductions, and additional tax credits.[7]

Federal Retirement Eligibility

Under federal law, non-disabled individuals are not eligible to receive Social Security income and healthcare coverage until reaching 67 years old (for those retiring after 2021).[8] Some individuals can apply “early” at sixty-two if they have earned forty credits or ten years of qualifying work.[9] Similarly, the IRS authorizes tax credits for qualifying Americans who turn sixty-five at the end of the taxable year.[10] Additionally, taxpayers sixty-five and older are entitled to a higher standardized deduction on their individual income tax returns.[11]

The rationale for preventing these young, retired players from enjoying the same benefits at the end of their career is that oftentimes they have yet to pay into the program for enough time, despite the massive amounts paid into these programs.[12] For example, most elderly Americans subsidize their expenses in their non-working years through Social Security retirement benefits, a tax contribution system where workers and employers each pay a 6.20% payroll tax toward the program for their working years that individuals can claim later in life.[13] However, without a carve-out for these career-athlete taxpayers and despite the enormous wealth they pay into the federal programs through withheld taxes, athletes do not qualify for these kickbacks until their sixties.[14]

Impact on Retiring Athletes

For athletes who compete in the pros for decades or sign massive corporate endorsement deals, walking away from a laborious career in their thirties or forties is ideal.[15] However, roughly 78% of career athletes either go bankrupt or face some severe financial stress within three years of ending their playing careers.[16] In 2015, the National Bureau of Economic Research reported that 2% of retired football players file for bankruptcy within the first two years of retirement and almost 16% by year 12.[17] With a global pandemic and unprecedented inflation hikes, the economic climate has unlikely positively affected these financially struggling retired athletes.[18]

In response to the federal benefits structure, many Players’ Associations follow other employment industries and bargain for private pension plans and retirement benefits as a part of their Collective Bargaining Agreements.[19] For instance, the NFLPA negotiated that members who play in two credited seasons are eligible for a severance payment from the league paid as a lump-sum retirement check, with an amount based on the total number of seasons played for the NFL.[20] Even so, an athlete who qualifies as “retired” for the NFL will be subject to the same federal tax withholdings and income tax rates, without elderly credits and deductions, if they accept these private pension payments before the qualifying age.[21] These tax consequences for NFL “retirees” also differ from federally qualifying retired persons who are only subject to paying federal tax on 85% of their Social Security Income.[22]

When considering the complexities of the U.S. Tax Code and Social Security Benefits, it’s no wonder it took Tom Brady two attempts at retirement to get it right.[23]

*Staff Writer, Jeffrey S. Moorad Sports Law Journal, J.D. Candidate, May 2024, Villanova University Charles Widger School of Law.

[1] See Emmanuel Morgan, Tom Brady Says He’s Retiring, for Good This Time, N.Y. Times (Feb. 1, 2023), https://www.nytimes.com/2023/02/01/sports/football/tom-brady-retires.html (reporting Brady announced retirement news through his personal social media after completing his worst NFL season with Tampa Bay Buccaneers).

[2] See Zac Al-Khateeb, Why is Tom Brady Called the GOAT? Hall of Fame QB’s Numbers, Accolades Speak for Themselves, Sporting News (Feb. 2, 2022), https://www.sportingnews.com/us/nfl/news/why-is-tom-brady-called-the-goat/1h4upx1oxgnpd17ggcvmhjqdjd (explaining Brady often referred to as “the GOAT,” acronym standing for Greatest Of All Time).

[3] See Amy Stoody, When Should an Athlete Retire? Bleacher report (July 25, 2008), https://bleacherreport.com/articles/41032-when-should-an-athlete-retire (arguing professional athletes should refrain from retiring if physically and mentally able to play, teams are willing to pay, and fans still support).

[4] See What is the Average Retirement Age of an NFL Player?, Sportscasting (Nov. 13, 2022), https://www.sportscasting.com/average-retirement-age-of-nfl-player/ (reporting statistics of average NFL career lasts 3.3 years, 27 years old, NBA is five years at 28 years old, MLB is five years at 29.5 years old, and NHL is six years at 28.2 years old).

[5] See Chris Mallard, End of Regulation: Why are NFL Players Retiring Earlier?, Penn Medicine News (Sept. 12, 2019), https://www.pennmedicine.org/news/news-blog/2019/september/end-of-regulation-why-are-more-nfl-players-retiring-earlier (explaining “Brian J. Sennett, MD, Penn Medicine’s chief of Sports Medicine” describes players engage in “the equation of pain versus pleasure”).

[6] See Form SSA-1 | Information You Need to Apply For Retirement Benefits or Medicare, Social Security Administration, https://www.ssa.gov/forms/ssa-1.html (providing steps for application and qualifications for eligibility).

[7] See I.R.S. Pub. 554 (2022), Tax Guide for Seniors [hereinafter IRS Pub. 554] (describing deductions and credits for elderly); see also Retirement Benefits, Social Security Administration, No. 05-10035, 1-2 (Jan. 2023) [hereinafter SSA Retirement Brochure], available at https://www.ssa.gov/pubs/EN-05-10035.pdf (explaining SSA retirement benefits structure and age eligibility requirements).

[8] See 42 USC § 416(l)(1) (defining retirement age

“(1) The term “retirement age” means—(A) with respect to an individual who attains early retirement age (as defined in paragraph (2)) before January 1, 2000, 65 years of age; (B) with respect to an individual who attains early retirement age after December 31, 1999, and before January 1, 2005, 65 years of age plus the number of months in the age increase factor (as determined under paragraph (3)) for the calendar year in which such individual attains early retirement age; (C) with respect to an individual who attains early retirement age after December 31, 2004, and before January 1, 2017, 66 years of age; (D) with respect to an individual who attains early retirement age after December 31, 2016, and before January 1, 2022, 66 years of age plus the number of months in the age increase factor (as determined under paragraph (3)) for the calendar year in which such individual attains early retirement age; and (E) with respect to an individual who attains early retirement age after December 31, 2021, 67 years of age.”).

[9] See 42 U.S.C. §§1395–1395lll (Social Security Act is administered by the Centers for Medicare and Medicaid Services); see also SSA Retirement Brochure, supra note 7 at 3 (explaining early retirement benefits accessible for qualifying contributors at age 62 at lower amounts until reaching “full retirement age” of 65 years old). Additionally, taxpayers who are disabled may qualify to receive federal benefits early, however, the analysis of disabled athletes is beyond the scope of this blog. See id. (providing persons that are disabled or suffer health problems and are forced to retire early may be entitled to Social Security benefits prior to reaching age 62).

[10] See IRS Pub. 554, supra note 7 (explaining taxpayers who file individual income tax returns can take credit if qualifying individual). The IRS considers a person to be a qualified individual if they are a) at least 65 years old or disabled and b) elderly and below certain income thresholds or if total nontaxable social security and nontaxable pensions. See id. (explaining taxpayers are considered to be age 65 on the day before their 65th birthday).

[11] See id. (providing provisions that give special treatment to older taxpayers who chose not to itemize deductions and elect standardized deductions).

[12] See Social Security and How It Works, USA.gov, https://www.usa.gov/retirement (last visited Feb. 24, 2023) (explaining Social Security is a program run by the federal government that works by placing taxes paid while working into a trust fund to provide benefits to people who are currently retired, while workers receive credits to become eligible for future benefits upon retirement later in life).

[13] See How is Social Security Financed?, SSA.gov, https://www.ssa.gov/news/press/factsheets/HowAreSocialSecurity.htm (last visited Mar. 6, 2023) (explaining payroll tax rates are set by law and apply to earnings up to a certain amount which rises as average wages increase).

[14] See Understanding the Benefits, Social Security Administration, No. 05-10024, 1-2 (Jan. 2023), available at https://www.ssa.gov/pubs/EN-05-10024.pdf (explaining The Social Security benefit programs are entitlement program which means workers, employers and the self-employed pay for benefits with their Social Security taxes that are collected and put into special trust funds and can be received depending on the taxpayer’s work history (or spouse or parent) and the amount of the benefit is based on these earnings.).

[15] See Max Molski, A Look Back at the Notable Athletes who Retired in 2022, NBC Sports (Dec. 21, 2022), https://www.nbcsports.com/boston/look-back-notable-athletes-who-retired-2022 (reporting 23-time Grand Slam singles champion Serena Williams, age 41, announced she would be “‘evolving away’ from tennis” in an editorial for Vogue Magazine in 2022).

[16] See Shaye Galletta, Why do Professional Athletes go Broke?, Fox Business (Feb. 2, 2022, 1:37 PM), https://www.foxbusiness.com/personal-finance/why-do-professional-athletes-go-broke (analyzing high number of athletes going bankrupt attributed to significant amount of money earned in short amount of time combined with common occurrence to gift people who supported career).

[17] See Kathleen Coxwell, Retired Athletes: 20 Valuable Lessons From Their Financial Victories and Agonizing Defeats, New Retirement (Mar. 25, 2021), https://www.newretirement.com/retirement/retired-athletes-financial-lessons/ (“According to authoritative reporting by Sports Illustrated, approximately 78 percent of NFL players either go bankrupt or face some serious financial stress within two years of ending their playing careers, while 60 percent of NBA players are broke within five years of retiring from the game.”).

[18] See How Many Credited Seasons do I Need to be Eligible for a Severance Payment?, NFLPA, https://nflpa.com/active-players/faq/how-many-credited-seasons-do-i-need-to-be-eligible-for-a-severance-payment (last visited Mar. 13, 2023) (explaining that due to Covid-19 pandemic and updated CBA, funding for benefits are postponed until after the 2023 league year).

[19] See Full Term Sheet of Proposed Collective Bargaining Agreement, NFL (Feb. 20, 2020, 12:28 PM), https://www.nfl.com/news/full-term-sheet-of-proposed-collective-bargaining-agreement-0ap3000001102608 (proposing benefit increases including: Pension increase of 10%, retroactive increase to $550 per month for all pre-2012 vested players, expand pension eligibility to all former players with three credited seasons); see also NFL Player Vote Ratifies New CBA Through 2030 Season, NFL (Mar. 15, 2020, 10:14 AM), http://www.nfl.com/news/story/0ap3000001106246/article/nfl-player-vote-ratifies-new-cba-through-2030-season (summarizing successful implementation of benefits for current and future retirees).

[20] See NFLPA, supra note 18 (explaining that players who return to football after receiving a severance payment can collect additional severance later, but only for the years played after the initial payment).

[21] See Rachel Hartman, How Pension Income is Taxed, U.S. News (May 13, 2022), https://money.usnews.com/money/retirement/aging/articles/how-pension-income-is-taxed (making the distinction between pre-tax pensions which are taxable when distributed and post-tax pension plans which are not).

[22] See Income Taxes and Your Social Security Benefit, Social Security Administration, https://www.ssa.gov/benefits/retirement/planner/taxes.html (last accessed Feb. 24, 2023) (explaining recipients who must pay federal income taxes on Social security benefits will follow different IRS tax rate brackets depending on filing single, jointly, or married filing separately).

[23] See Janaya Wecker, 30 Athletes Who Have Come Out of Retirement Over the Years, Men’s Health (Jan. 26, 2023), https://www.menshealth.com/entertainment/g42589949/athletes-who-have-come-out-of-retirement/ (highlighting Brady’s first attempt to retire in March 2022, changing his mind forty days later and returning for the 2022-2023 season).